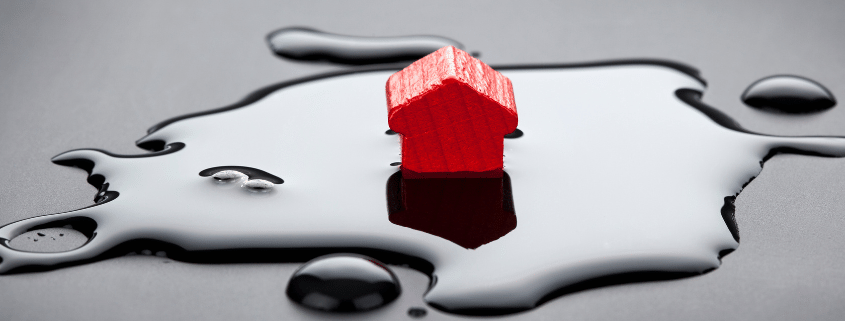

Many homes in the United States are located within flood zones. As the recent Yellowstone flooding shows, homeowners don’t know the risks or aren’t prepared to deal with them.

You should assess this potential and take preventative measures if necessary before you end up submerged!

Nearly all homes located in flood-prone areas are near a body of water. The Gulf Coast, for example, is the most susceptible to flooding caused by hurricanes. However, more than 20% of flood-related home insurance claims are made in areas that are not affected by flooding.

Flooding may become more frequent due to climate change. Popular Science reports that “nearly 15,000,000 American properties are at significant risk of flooding within the next 30 years, and more than 3 million will be submerged at some time in that period.”

How can you determine if your house is in a flood area? And if so, how do you calculate the risk, and what protections you can put in place? This is how you can find out if your home is in a flood zone.

How to determine if your home is in a flood area

There are several ways to determine the flood risk status of a home. The flood risk tool is a good place to start. It provides a single portal that highlights two flood risk ratings for each property. You can access the Federal Emergency Management Agency site by entering the address of a property and viewing a map that shows flood zones.

FEMA has over a dozen flood zone classifications. These are based on how often storms could cause flooding in an area. A Special Flood Hazard Area is a zone that is high-risk. FEMA states that SFHAs have a 1% chance of flooding each year, (also known as the 100-year flood or base flood).

Moderate flood zones are labeled with a B or X and reflect a 0.2 % annual chance of a flood (also considered a 500-year flood). For example, areas like Northshore subdivisions in Louisiana have the lowest chance of flooding.

FEMA flood maps are not the only flood risk tool you should be using.

FEMA flood maps can be trusted as a government resource for flooding. However, many maps are decades old. This means that you might not have the most up-to-date information about a home’s flood risks. FEMA data can be used to calculate insurance risk and building code requirements but they don’t necessarily predict the probability that a property will flood in the future.

This is why the flood risk tool includes Flood Factor data, which was created by First Street Foundation. Flood Factor is used in conjunction with FEMA. However, this tool uses current data based on changing climate conditions to predict a home’s likelihood of flooding in the near future.

FEMA maps and Flood Factor ratings are great tools to help you assess a property’s flood risk. However, these numbers can only give you an idea of the property’s future flooding risk.

Other than flood maps, tax records databases and title searches are also good resources. These should help you determine if your property is at risk of flooding.

Ben Bailion, a real estate agent and attorney from Atlanta’s Re/Max Town and Country says that “you can also ask your agent about home insurance”.

Are home shoppers informed about a property’s flood status?

Although all states have laws concerning property disclosure, FEMA flood zone status laws vary between states, according to Tony Carper, owner, and operator of J and J Home Inspections.

Previous flooding is not required by federal law. However, in New York and other states, sellers must disclose to potential buyers whether the property has been in floodplains or has been flooded in accordance with the law.

Regardless of state laws, full disclosure is the seller’s ethical responsibility and the listing agent’s.

You should do your research on the property and check flood maps (or ask your agent to check) to determine if it is in a flood zone. The mortgage company will also check the most current flood zoning if you are applying for financing.

If the property is found to be in a flood zone, the mortgage company will require flood insurance.

What are the costs of flood insurance?

Did you know that many home insurance policies do not cover flooding-related damage? Flood insurance is often required for homes in high-risk zones.

Through the National Flood Insurance Program, the federal government provides flood insurance that is subsidized to property owners. Flood insurance through the NFIP costs an average of $734 annually.

The amount you pay will depend on where you are located in the floodplain and your property’s flood risk.

Carper warns that flood insurance may be more costly if you live in an area with high flood risk. Vermont, for instance, has the highest flood insurance at $1,512 annually.

Flood insurance costs also depend on your house. This includes factors such as years of construction, number and location of lowest floors (in relation to the base flood elevation shown on a flood map), building occupancy, contents location, and your deductible.

Does being in a flood zone affect a home’s price?

No matter if you are a buyer or seller, remember that flooding can affect a home’s value. Why? FEMA states that flooding can cause as little as a millimeter of damage to a property, which can result in up to $25,000 in damages.

Annunzio says that “sellers are aware of the impact flood insurance can have on buyers’ budgets”. These extra costs will likely be taken into consideration by sellers when they price their home.

Buyers might also consider the property less desirable if there is a high risk of future flooding. A motivated seller might list it a little lower.

If you feel that a home’s flood risk is too high, it is a good point to negotiate.

Do you need flood insurance if you are in an area that is not at risk of flooding?

Flood insurance is recommended for those who live in areas with moderate to low risk within or outside of a floodplain.

Flood zones are determined by the likelihood of flooding occurring in your area. You want to be protected in case something happens. According to the Harris County Flood Control District, about two-thirds of all properties that were affected by Hurricane Harvey in 2017 were located outside the 100-year floodplain.

If you are unsure whether to buy flood insurance or not, consider this: Is the risk of flooding and the potential damage that it can cause worth the insurance premium?

Flood insurance can provide protection and peace of mind in certain cases. Keep in mind that the FEMA map may show that your house is not in the flood zone.

Flood Damages: How to Minimize Your Losses

Carper recommends these steps if your home is located in or near a flood area:

- Proper grading is where the ground slopes slightly down around your home to prevent water from seeping inward. A flood insurance policy won’t typically cover you if your home floods because of poor grading. This problem can be solved by a landscaper who will add soil to the foundation of your home.

- To protect your furnace, water heater, and electric panels from flooding, you should elevate them.

- Make sure your gutters and storm drains are free from debris and that you have check valves (or one-way valves) installed to prevent floodwater from backing up into your drains.

- Use waterproofing products to seal your basement walls.

- Your valuables and legal documents should be stored on the upper floors.