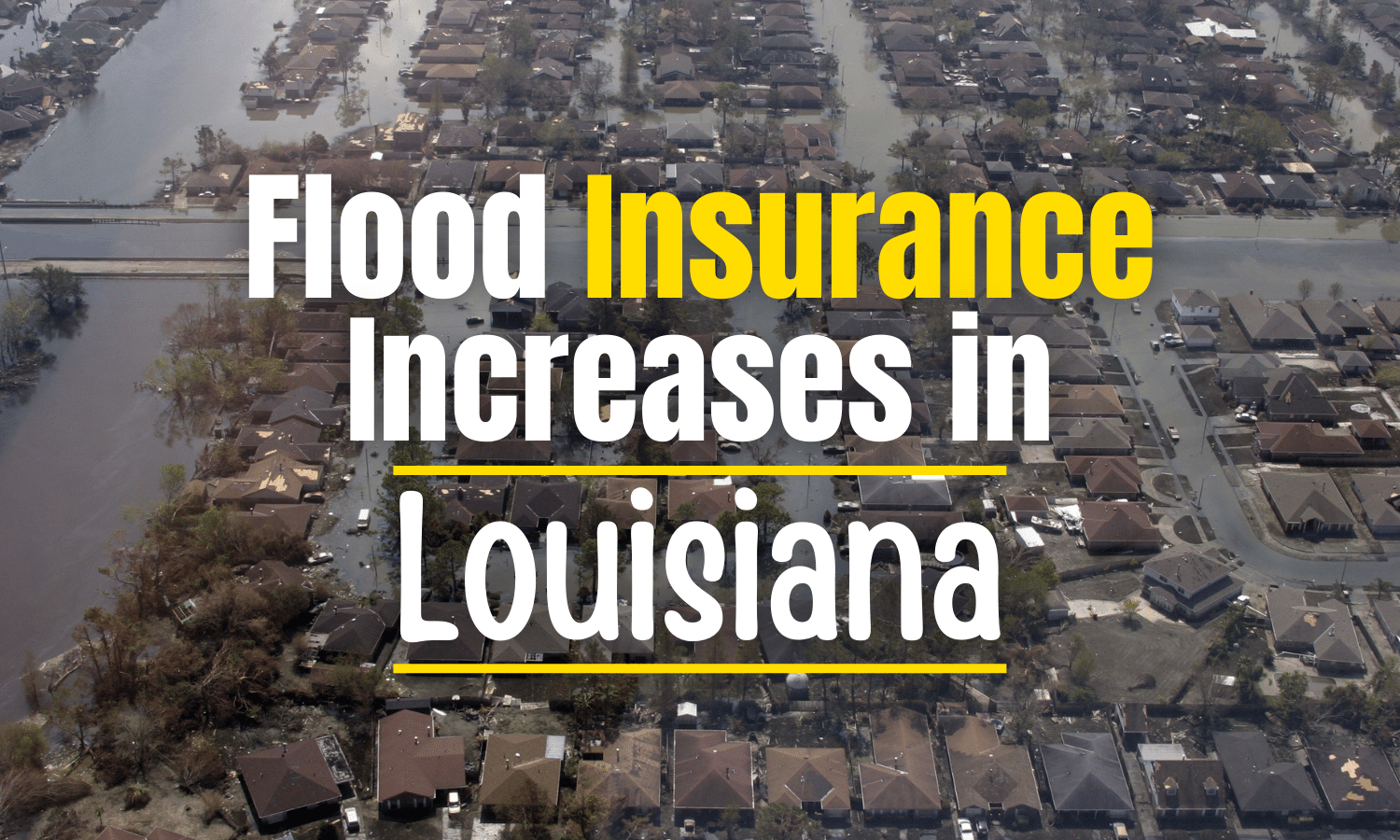

The city of Lake Charles in southwest Louisiana has been subject to two hurricanes and intense rains over the past year. Tommy Eastman could lose coverage on his four-bedroom home, which has so far been unaffected by flood damage, because of rising costs for his flood insurance. Risk Rating 2.0 will affect a huge amount… Continue reading Flood Insurance Costs Increase in Louisiana

Category: real estate

How Does Flooding Affect Property Values?

Louisiana is known for flooding. From Hurricane Katrina, which was one of the most destructive flooding events to ever hit the United States, to simply a flash flood that takes place in New Orleans, when the pumps don’t work properly, Louisiana residents are used to dealing with flooding events. How Flooding Affects Property Values… Continue reading How Does Flooding Affect Property Values?

What You NEED To Know About Flood Insurance

Everything That You Need to Know about Flood Insurance While most homeowners have home insurance, there is one protection that they fail to take into account – flood insurance. Homeowners insurance does not clover flooding, and as we have seen in recent years, even areas that didn’t get flooded in the past are now experiencing… Continue reading What You NEED To Know About Flood Insurance

Buying a Home: Needs vs Wants

Wants vs. Needs: Making a Home Buying Checklist The home buying process is a long, and sometimes difficult one. But there can be a lot of excitement around the prospect of a new home. Whether this is the first home, or the tenth, you are bound to have ideas about what you like and don’t… Continue reading Buying a Home: Needs vs Wants